north carolina estate tax exemption 2019

If a person dies in 2019 she can leave a 114. Premium Federal Tax Software.

![]()

Estate Tax What Is The Current Estate Tax Exemption Carolina Family Estate Planning

2019 North Carolina General Statutes Chapter 159I - Solid Waste Management Loan Program and Local Government Special Obligation.

. Up from 1118 million per individual in 2018 to 114 million in 2019. NC Gen Stat 131A-21 2019 131A-21. The Estate Tax Exemption.

Tax is tied to federal state death tax credit. If you died and this was the only asset you have you would receive an estate tax exemption or coupon of 549 million leaving a taxable estate of approximately 1000000 and an estate tax bill of approximately 346000. The Internal Revenue Service IRS recently announced that the estate and gift tax exemption is increasing next year.

2019 North Carolina General Statutes Chapter 131A - Health Care Facilities Finance Act 131A-21 - Tax exemption. The Internal Revenue Service announced today the official estate and gift tax limits for 2019. The exemption is 4 million as of 2021.

A set of North Carolina homestead exemption rules provide property tax relief to seniors and people with disabilities. Estate and inheritance taxes are burdensome. NC K-1 Supplemental.

The annual gift and estate tax exemption is the dollar amount worth of gifts that you can give away in your lifetime before you have to pay an actual gift tax. North carolina department of revenue. The North Carolina State Tax Tables for 2019 displayed on this page are provided in support of the 2019 US Tax Calculator and the dedicated 2019 North Carolina State Tax Calculator.

16 West Jones Street. North Carolina State Personal Income Tax Rates and Thresholds in 2022. Beneficiarys Share of North Carolina Income Adjustments and Credits.

Delaware repealed its estate tax in 2018. All Extras are Included. NC Gen Stat 159I-23 2019 159I-23.

This exemption may also be used during a persons lifetime to cover lifetime gifts that exceed hisher annual GIFT TAX exclusion 15000 for 2019 as discussed below. Importantly if the taxpayer deducts the maximum 10000 for real estate taxes paid or accrued during the taxable year on the State return the taxpayer can also deduct up to 10000 for mortgage expenses paid or accrued if the mortgage expense meets. But for individuals the Tax Cuts and Jobs Act raised that to 117 million for 2021 and 1206 million for 2022.

In addition to the deductions for marital and charitable transfers there is a. 21 2019 North Carolina attempted to tax the income of the Kimberley Rice Kaestner 1992 Family Trust because the trusts beneficiaries were all North Carolina residents even though the grantor was a New York resident the trust was governed by New York law and there was no. The estate tax exemption is the amount a.

For the year 2016 the lifetime exemption amount is 545 million. This amount can vary from year to year. If you are totally and permanently disabled or age 65 and over and you make.

5520 sharon view rd charlotte north carolina 28226. They disincentivize business investment and can drive high-net-worth individuals out-of-state. The exemption will be phased in as follows.

100 Free Federal for Old Tax Returns. An individual who files a North Carolina return as married filing separately may not deduct more than 5000 of real estate taxes. The estate tax is paid by the estate whereas the inheritance tax is levied on and paid by the beneficiary who receives a specific bequest.

26 rows What is the North Carolina estate tax exemption. 114 million exemption for 2019 for all other transfers. A 1 million estate in a state with a 500000 exemption would be taxed on 500000.

The estate and gift tax exemption is 114 million per individual up. Individual income tax refund inquiries. Part ii will discuss estates and gifts.

Its at 59 million as of 2021 with a top tax rate of 16. Kimberley Rice Kaestner 1992 Family Trust No. On May 31 2018 Connecticut changed its estate tax law to extend the phase-in of the exemption to 2023 to reflect the increase in the federal exemption to 10 million indexed for inflation in the 2017 Tax Act.

The federal estate tax exemption is 1118 million in 2018. This bill will annually increase the states estate tax exemption until it matches the federal estate tax exemption of 117 million in 2023. Its based on the value of.

Ad Prepare your 2019 state tax 1799. North Carolina General Assembly. The exercise of the powers granted by this Chapter will be in all respects for the benefit of the people of the State and will promote their health and.

All of the bonds and notes authorized by this Chapter shall be exempt from all State county and municipal taxation or assessment direct or indirect general. 7 The District of Columbia Washington DC continues to tax estates at a top rate of 16. Raleigh NC 27601 919 733-4111 Main 919 715-7586 Fax.

North carolina estate tax 2019. In the Tax Cuts and Jobs Act the federal government raised the estate tax exclusion from 549 million to 112 million per person though this provision expires December 31 2025. The exemption was then scheduled to continue to increase on an annual basis until it matches the federal estate tax exemption in 2019.

How Is Tax Liability Calculated Common Tax Questions Answered

How To Avoid Estate Taxes With A Trust

Guide To Nc Inheritance And Estate Tax Laws Hopler Wilms Hanna

Filing Taxes For Deceased With No Estate H R Block

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Recent Changes To Estate Tax Law What S New For 2019

Recent Changes To Estate Tax Law What S New For 2019

Guide To Nc Inheritance And Estate Tax Laws Hopler Wilms Hanna

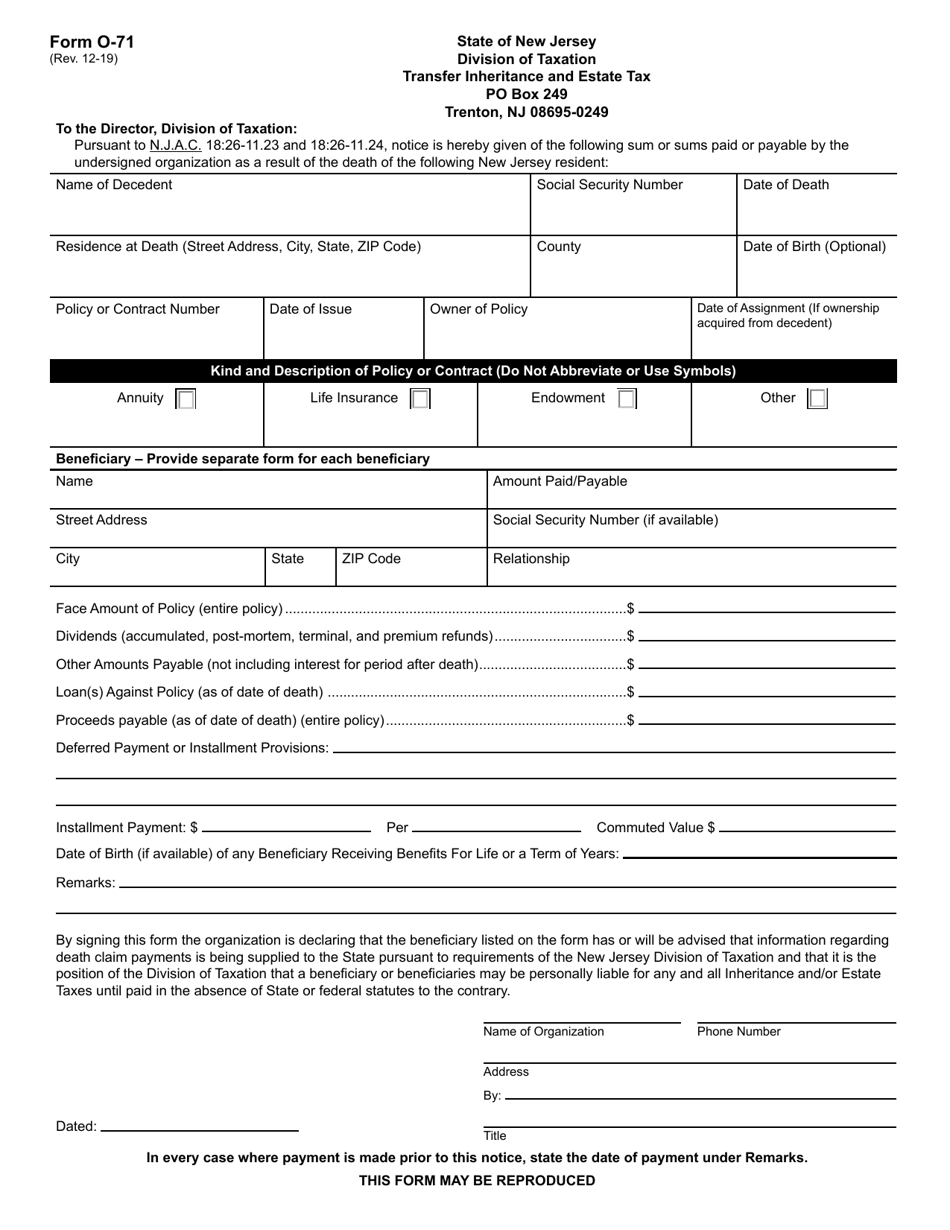

Form O 71 Download Fillable Pdf Or Fill Online Transfer Inheritance And Estate Tax New Jersey Templateroller

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Eight Things You Need To Know About The Death Tax Before You Die

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

Ohio Sales Tax Changes Sales Tax Nexus Tax

How To Avoid Estate Taxes With A Trust

States With No Estate Tax Or Inheritance Tax Plan Where You Die

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Is Your Inheritance Considered Taxable Income H R Block

What Is A Charitable Remainder Trust Carolina Family Estate Planning